Collectible Automobile Asset Manager Establishes Brand Visibility

M&Co helped Drift Capital enhance its brand awareness and appeal to high-net-worth investors, advisors, and institutional investors.

Read Case Study

Expert in advising on CEO and C-Suite transitions, key transformational initiatives, and Board level issues.

Full solution set for communicating mergers and acquisitions, IPOs, and strategic sales/liquidity events for both public and private companies, emerging and enterprise, across global markets.

Advising on communications with investors and buy and sell-side analysts, quarterly and annual earnings calls, annual reports, and sustainability reporting.

Key hires and leadership transitions

New market penetration

Business partner announcements

Rebranding

Roadshows and investor conferences

Capital raises

IPOs

Quarterly & annual reporting and analyst relations

Mergers & Acquisitions

Regulatory disclosures

Integrated with our regulatory, law enforcement, and public affairs services and solutions

Capabilities that extend across global money and media center markets

M&Co helped Drift Capital enhance its brand awareness and appeal to high-net-worth investors, advisors, and institutional investors.

Read Case Study

A prominent global corporate governance and proxy solicitation firm, sought to create a marketing campaign around its 50th anniversary.

Read Case Study

Following a merger, Federated Hermes wanted to emphasize its global leadership role in ESG and responsible investing.

Read Case Study

Brazil’s largest investment bank, Itaù BBA, wanted to raise its profile in the U.S. and U.K./European media markets focusing on its M&A advisory capabilities, corporate banking services and asset management.

Read Case Study

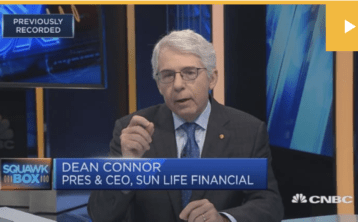

Dean Connor, CEO and President of Sun Life Financial, wanted to communicate his confidence in the Asian market to investors.

Read Case Study